The highly anticipated SS&C Intralinks 2023 LP Survey has just been published. An essential read for those involved in the private market, the LP Survey offers a wealth of insights for general partners (GPs) looking to understand limited partners’ (LPs) sentiments toward their current funds, how they select general partners (GPs) and allocation plans for the next 12 months.

Produced in association with Private Equity Wire, two key themes emerge from the survey of 200 LPs based globally.

Firstly, a majority of LPs plan to increase their allocations to alternative investments in the coming 12 months. According to our findings, 72 percent of LPs plan to increase their allocations to alternatives, with 32 percent aiming to grow their holdings by 10 percent or more. Private equity (PE) was selected as the most appealing asset class with 29 percent expecting to be overweight there.

“The increase in asset allocation to alternatives was not surprising to see,” says Fiona Anderson Wheeler, managing director, investor relations at BC Partners. “Across the board, you continue to see allocators recognizing that private equity, in particular, provides outsized returns and therefore [they are] seeking to add more.”

That brings us to the second key finding: an increased focus on environmental, social and corporate governance (ESG) due diligence.

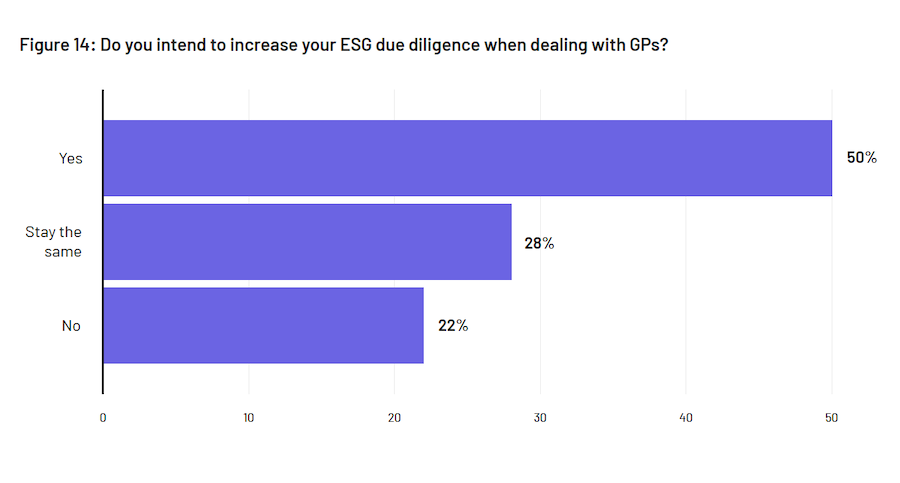

The LPs we surveyed plan to tighten their due diligence around ESG in the coming year. LPs revealed they intend to increase their ESG due diligence when dealing with GPs — 50 percent said they plan to raise the stakes in this regard. Furthermore, 37 percent said they are “likely” or “very likely” to divest from funds that aren’t willing to show their updated ESG policy on an annual basis.

Interestingly, more than 38 percent of LPs said they “rarely” or “never” engage with GPs on ESG reporting. This figure is likely to increase as GPs make greater efforts in this area. Technology can also assist; however, GPs must be prudent in the way they handle any solution deployment.

Asked about their frustrations with GP technology, LPs said they struggle with disparate dashboards with multiple logins (35 percent). Around three in 10 also lament their experience around access to on-demand reporting and analytics.

More from the LP Survey

The largest cohort of survey participants was comprised of banks and wealth managers (29 percent), with family offices making up over a quarter (26 percent) and pension funds accounting for 18 percent of the sample. They were primarily located in North America (36 percent) and Europe, the Middle East and Africa (34 percent). The balance was comprised of LPs from Asia Pacific (18 percent) and Latin America (12 percent).

Facing a mix of opportunities and challenges in the form of inflation, rising interest rates and flatter multiples, the Alternative Investment Fund Managers Directive (AIFMD) review, sky-high fuel and energy prices, as well as food and commodity shortages linked to the conflict in Ukraine, LPs have a lot to handle.

Given market uncertainty and high levels of volatility, getting a gauge of LP intent is critical for GPs to understand their current approach to risk and opportunity.

GPs aiming to benefit from the rise in allocations need to have their approach to sustainability in order. Close communication with GPs during tumultuous times can help them to navigate headwinds and take advantage of investment opportunities that could see them through to calmer times.

To get the full story on LP sentiment for the next 12 months, download the 2023 SS&C Intralinks LP Survey here.